Dialogue with Zhu Jiangming of Leapmotor: A Rare Growth Story of an Automobile Company in 2024. In the future, midsize and large SUVs should be sold for only 50,000 yuan.

In 2024, the competition in China’s auto market was extremely fierce, yet Leapmotor unexpectedly emerged. At the beginning of the year, its monthly sales were around 10,000 units. In November, its sales exceeded 40,000 units. Among the new energy vehicle manufacturers, only Li Auto and HarmonyOS Intelligent Mobility had higher sales than it.

Its growth stems from one point – making more cost-effective cars for the mass market. Zhu Jiangming, the founder, summed it up as pricing based on cost, controlling costs well, and doing a good job in product and marketing. He has a view that midsize and large SUVs should sell for only 50,000 yuan in the future.

In the automotive industry, this is definitely a non-consensus.

Born in 1967, Zhu Jiangming started his entrepreneurial career 31 years ago. He is the co-founder and CTO of Dahua Technology, a leading security company. With the experience of large-scale software and hardware integration and the aspiration to succeed again, he entered the automotive industry in 2015.

Zhu Jiangming hardly posts on Weibo and doesn’t like to teach others how to make products. Ten years into the business, the only product they have made is cars. He is good at saying the most powerful words with the calmest expression: “Our cost control ability is no worse than BYD’s.”

Everything should be fully integrated: cars should use the same parts as much as possible. The highly integrated electronic and electrical architecture LEAP 3.0 independently developed by Leapmotor has a universality rate of over 80%. Parts should be integrated as much as possible, and factories should be concentrated. They only build vehicle manufacturing plants in two cities – as summarized by a Leapmotor manager, behind the integration is “Zhu Jiangming’s pursuit and aspiration for simplicity”.

Investment should also be restrained to the maximum extent. Leapmotor spent only 3.6 billion yuan on independently researching and developing the core components such as batteries, electric drives, and electronic controls, less than half of that of other new energy vehicle manufacturers. The reason is that they try to operate with light assets. For example, most of Leapmotor’s factory buildings are leased.

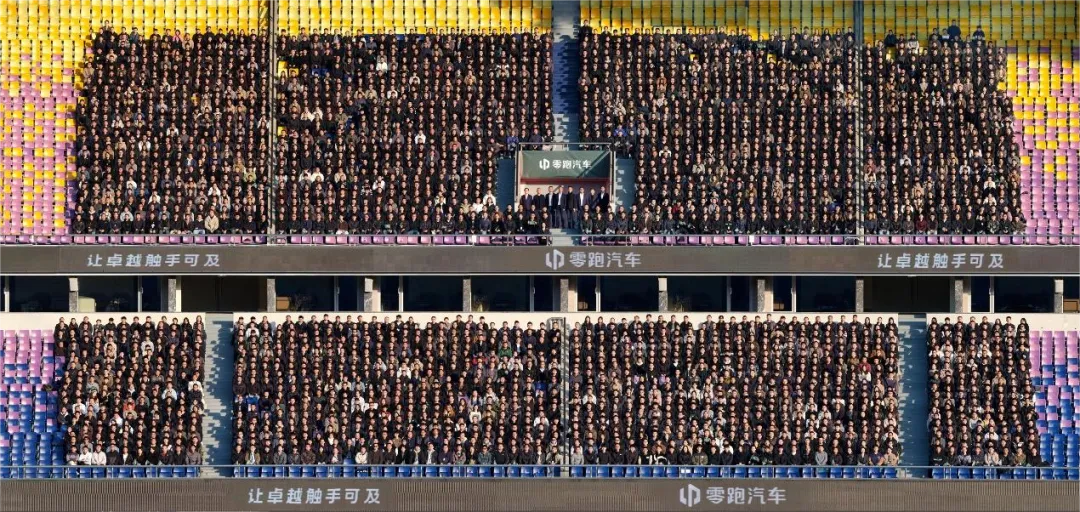

Leapmotor has 10,000 employees, one-third of that of Li Auto, but it has around 5,000 engineers. Zhu Jiangming said that in six years, the sales volume will increase tenfold, but the number of engineers should not exceed 10,000 – only double.

Leapmotor chooses to target the mass market. Although the 100,000 – 150,000 yuan market has the largest scale, it has numerous competitors and directly faces BYD. So the strategic core is to achieve large-scale sales with low gross profit under the condition of cost leadership. Zhu Jiangming said that Leapmotor does not pursue high gross profit and brand premium. “Even for a 200,000 yuan car, it still has a low gross profit.”

Long-term low gross profit is like walking on the edge of a cliff, which requires a lot of courage. In the third quarter of 2024, Leapmotor’s gross profit margin was 8.1%, a “historic high”, but it was still much lower than that of Li Auto (21.5%) and NIO (13.1%). When the gross profit margin first turned positive, Leapmotor had been established for eight years. The lowest point was in 2019, with only -95.7%.

Sales volume means everything. Its sales target for next year is 500,000 units, rising to 1 million units in three years, and reaching 4 million units in six years. “Full speed ahead. When it’s time to take action, we should move forward quickly.” Next, Leapmotor will use thirteen or fourteen models to cover the 60,000 – 300,000 yuan market. By next year, the number of sales channels will increase from around 800 at the end of this year to over 1,000, and the annual production capacity of the new factory will increase to 1 million units.

When not noticed, Leapmotor is not conspicuous. But when peers, competitors, and users notice it, they will find that it is already hard to be shaken and even harder to be eliminated – because its goal is single and extreme.

The following is the conversation between LatePost Auto and Zhu Jiangming, the founder and chairman of Leapmotor:

Leapmotor was calm in the most intense 2024

LatePost: Leapmotor’s sales exceeded 20,000 units for the first time in June this year, and doubled to 40,000 units five months later. In the fiercely competitive 2024, this is almost a sales miracle. How did you achieve this?

Zhu Jiangming: I think it’s the superposition effect of multiple factors. The normal situation in the auto market is that sales in the first half of the year are relatively low and increase in the second half. Our C10 was launched in March and C16 was launched in June. Coincidentally, there were national subsidy policies. In addition, the number of sales channel outlets increased, and more Leapmotor cars were on the road, which also improved the brand awareness and trust.

LatePost: Did low-priced models contribute the vast majority of sales?

Zhu Jiangming: The proportion of the T03 priced between 49,000 yuan and 69,000 yuan has been declining every month. In the first half of the year, it accounted for 20% – 30% of the total sales, and now it only accounts for 10%.

LatePost: Among the startup car companies, some have more resources than you, such as Jidu, and some have a more professional background than you, such as WM Motor, but they have all failed. Leapmotor has become a dark horse. If you have to sum it up in one reason, what is it?

Zhu Jiangming: Focus on technology and make products competitive enough. For consumers, they will only pay when they think the products are worth more than their prices. It’s a very simple truth. The C10 and C16 are examples, with just the right configurations. By “right”, we need to consider both the cost and customer needs.

LatePost: These two models are very similar, and their launch times are only three months apart. Why did you make them into two models?

Zhu Jiangming: They are essentially the same car, with 80% of the parts like headlights and doors being the same. We modified them into two models. The C10 has five seats, and the C16 has six seats.

When developing the C10 in 2022, I saw that the Li Auto L9 was selling very well. I was thinking whether we could make another six-seater car based on the C10. Make it at a relatively low cost, and there would definitely be a market. The team started to make modifications on the original car. “Kill two birds with one stone.” We quickly defined the product, and the investment was low. With 1.2 to 1.3 times the development cost, we made two models, and each model could sell more than 10,000 units.

A new energy vehicle manufacturer with good sales also sent people to learn from us and asked, “Why can the C16 be sold at such a low price?”

LatePost: If there hadn’t been the inspiration from the Li Auto L9, would there still be a six-seater car?

Zhu Jiangming: I hadn’t thought about launching it at that time. According to the original plan, the six-seater car would not be launched until 2026, and it would be a car priced at over 200,000 yuan. In fact, it was launched more than a year earlier.

If I hadn’t seen Li Auto’s car, I might not have thought of it, but once I saw it, we made decisions quickly and took actions rapidly. From the moment I had this idea to the meeting with the team, it was only one or two days, and we started the project half a month later.

LatePost: Where does this ability to seize fleeting opportunities come from?

Zhu Jiangming: This is my specialty. We are a startup team, and I’m from the IT industry, so I’m used to rapid iteration and quick decision-making.

LatePost: There is something counter-intuitive. For example, although your sales have almost doubled, the number of sales stores is 60 more than that at the end of 2023. Why?

Zhu Jiangming: This year, we are adjusting the store structure. In the past, the stores were relatively scattered, and shopping mall stores accounted for the majority. They were not cheap, and it was inconvenient for vehicle delivery and maintenance, and there were also many conflicts among dealers.

This year, we have increased the number of 4S stores, trying to make sure that there are relatively few investors in each region. We hope that they will build 4S stores first, and then set up city showrooms, shopping mall stores, or smaller satellite stores around them. At the beginning of the year, there might have been less than 100 4S stores, and by the end of the year, it will increase to around 280. Together with other stores, the total number will be close to 800. We will continue to expand to more regions next year and increase the number to over 1,000.

LatePost: Store resources are limited. Li Auto and AITO are developing fuel vehicle dealers. How do you compete for them?

Zhu Jiangming: Leapmotor’s dealers are basically making money now. In the fourth quarter of this year, 80% – 90% of the dealers are profitable, so they will be very willing to cooperate with Leapmotor.

We give dealers a rebate of 5% – 6% of the selling price, and the regulations are relatively loose, and we don’t force them to stock up.

LatePost: The sales volume has doubled, but the marketing expenses have only increased by less than 25%. How did you achieve this?

Zhu Jiangming: We are quite restrained in marketing spending, and the accuracy is also higher than before.

LatePost: This year, Leapmotor’s gross profit margin has also increased from -1.4% in the first quarter to 8.1% in the third quarter.

Zhu Jiangming: It’s mainly due to the scale effect. In addition, starting from the second quarter, all products have been switched to the LEAP 3.0 architecture, and the cost structure has changed a lot. Comparing the 2023 and 2024 models of the C11 and T03, the mileage has increased, but the overall cost has decreased, and the overall gross profit margin has improved.

Besides, the gross profit margin was already 6.7% in the fourth quarter of last year. The low figure in the first quarter of this year was affected by the clearance of 2023 inventory.

LatePost: In 2024, most car companies were struggling. Did Leapmotor make any mistakes in strategy or implementation?

Zhu Jiangming: Currently, everything is developing in the expected direction. Whether it’s the domestic market or overseas expansion, we have had a relatively smooth year.

But of course, there are also many challenges. In May this year, I held a press conference with Carlos Tavares (former CEO of Stellantis). He said that all entrepreneurs are in the process of solving problems.

Midsize and large SUVs should sell for only 50,000 yuan in the future

LatePost: One and a half years ago, you said that the price of midsize and large SUVs should be 50,000 yuan in 10 years. Do you still think so now?

Zhu Jiangming: Yes.

LatePost: Now the “idiot index” of cars (a concept from Elon Musk, referring to the price of a product divided by the cost of raw materials) is already close to 2. If midsize and large SUVs are sold for 50,000 yuan, wouldn’t cars be sold just based on the price of steel raw materials?

Zhu Jiangming: It must be like this.

LatePost: One of the premises of this conclusion is that the cost of batteries will drop to 0.3 yuan/Wh in 10 years, but now it’s already 0.32 yuan/Wh.

Zhu Jiangming: So there is still room for it to go down. It’s certain that cars will become cheaper and cheaper. It will gradually become a means of transportation, and people will only care about its durability and reliability, and the brand premium space will become smaller and smaller. Just like LED TVs, people don’t care as much about whether it’s a Sony or other brands. Five years ago, could you imagine that a 100-inch TV only cost 9,000 yuan?

The premium space for electric vehicles is already smaller than that for fuel vehicles. In the past, a fuel vehicle with an acceleration from 0 to 100 km/h in 4 to 5 seconds could be sold for 1 million yuan. Now no one will pay for an extra second of acceleration. Now it may be about competing in intelligent driving, but when 100,000 yuan cars also have lidar and intelligent driving functions, this aspect will also be leveled.

The BYD Seagull and Geely Xingyue are now about 70,000 to 80,000 yuan. Isn’t it just one step away? It’s just a matter of making the body a bit larger and adding more batteries.

LatePost: That cars will gradually degenerate into a means of transportation has become a consensus among new energy vehicle entrepreneurs?

Zhu Jiangming: Maybe not yet. Some people are still thinking about (luxury cars).

LatePost: You mentioned “luxury for all” before.

Zhu Jiangming: Because only in this way can society be changed.

When we graduated from university, we had to save money for many years to buy a TV. Now it may only take one month’s salary. This is the progress of society. So the next step is whether we can buy a car with half a year’s salary. Don’t create an identity difference just because I drive this brand and he drives another brand. A car is just a means of transportation.

LatePost: You firmly believe that cars will become cheaper and cheaper. Then why are you going to make the D series with the highest product positioning in 2026?

Zhu Jiangming: The D series is super luxurious in terms of product but not in price. We hope its interior is no worse than that of Maserati.

We have always said that Leapmotor hopes to be the Uniqlo in the automotive industry, making good products that are not expensive. The difference is that Uniqlo doesn’t have high-end products like Zegna or Chanel, but Leapmotor needs to have them. The 200,000 – 300,000 yuan market is a large automotive consumer market, and it’s also the pricing range of the D series.

In the market above 200,000 yuan, we still price based on cost, not on brand. We will sell clothes worth 20,000 yuan at a price of 2,000 yuan.

LatePost: In 2022, Elon Musk also thought about making the Model 2, the cheapest car in the automotive industry, but later he postponed or gave up this low-priced model and turned to invest in Robotaxi instead. He thought it had greater value.

Zhu Jiangming: Elon Musk didn’t make the Model 2 because he thought he couldn’t compete with Chinese companies in terms of price. The cost of that car couldn’t be reduced any further.

LatePost: What’s the trick for Leapmotor to control costs?

Zhu Jiangming: First, it’s platformization. Whether all products can use the same parts. Second, do more integration. Third, work with suppliers on solution innovation.

For example, all the 2025 models of the C series will be changed to electric door handles, which will increase the cost of each car by more than 500 yuan. So we asked the suppliers how to reduce the cost. We will purchase three to four hundred thousand units next year, right? The suppliers need to bring the cost down to an appropriate level, and this way, the cost is reduced by 15%.

In addition, the independent controller for the electric door handle also costs more than 100 yuan. We integrated it into the domain controller, and this cost was also saved.

LatePost: Can it still be reduced further?

Zhu Jiangming: This is the first step. But we thought it wasn’t economical enough, so we jointly designed with the suppliers and further adjusted the plan, and it can be reduced by another seventy to eighty yuan.

LatePost: Can it still be reduced further? How to judge the bottom line?

Zhu Jiangming: Ultimately, we need to calculate the real cost based on how many grams of plastic and how much steel are used.

We also need to give suppliers a reasonable profit, and we still have to rely on solution innovation to reduce costs.

LatePost: How often do you negotiate prices with suppliers?

Zhu Jiangming: There is definitely an annual price reduction. For high-value-added parts, we may negotiate prices every six months.

LatePost: You believe that the brand premium of cars will become lower and lower, and ultimately it will be about competing on the cost-performance ratio of products. If you have to sum up Leapmotor’s strategy in one sentence, is it “achieving scale with low gross profit”?

Zhu Jiangming: Yes, but our products must all exceed expectations. This is the quality-price ratio.

LatePost: Who inspired you?

Zhu Jiangming: I have a friend who runs the Shenzhou International Group in Ningbo. It’s the largest supplier for Nike, Adidas, and Uniqlo. They don’t make their own brands but just do OEM. By integrating the industrial chain and achieving a large enough scale, they have excellent cost control and are listed in Hong Kong, with a net profit of 5 billion yuan a year.

The difference for us is that we need to build our own brand, but we also need to make refined products that are good and not expensive.

LatePost: If you are used to making Uniqlo-like products, do you really know how to make products like Zegna or Chanel? Will the product strategy for Le